- 2026 (7)

- February (5)

- January (2)

- 2025 (56)

- December (9)

- Turn of the Year 2025

- Statement on Cuts to Research and Development Funding in the Czech Republic

- Looking Beyond Averages: An Interview with Stephanie Ettmeier

- Ole Jann Wins Jan Švejnar and Katherine Terrell Teaching Prize for 2024/2025

- CERGE-EI Festival 2025: A Day of Ideas, Encounters, and Shared Curiosity

- Confidence, Curiosity, and California: Reflections on a Study Stay Abroad

- Admissions Open for CERGE-EI Study Programs

- CERGE-EI Students Succeed in the Young Economist of the Year Competition

- Three CERGE-EI Students Awarded the 2025/2026 Alumni Excellence Fellowship

- November (6)

- Discover Careers in Economic Research: CERGE-EI Festival

- Meet Our Alumni: Iva Martonosi

- Introducing CERGE-EI's Job Market Candidates 2025/2026

- Bachelor’s Program in Economics of Markets and Organizations

- Focus of The Price of War 2025: Economic Security and Freedom

- The Week of CAS at CERGE-EI: Exploring How Economics Shapes Our World

- October (4)

- September (4)

- August (5)

- July (5)

- June (11)

- Webinar for Academic Advisors: Economics Education in Europe

- Newly Admitted Students Day

- Talking Economics: Household Financial Choices

- CERGE-EI and Prague University of Economics and Business open a new Bachelor's program Economics of Markets and Organizations

- Meet Our Alumni: Emiliya Lazarova

- Congratulations to Sebastian Ottinger on receiving the 2025 Otto Wichterle Prize

- Christian Ochsner on the Long-Term Impact of the Spanish Flu Pandemic on Public Trust

- Jakub Steiner Appointed Editor of the Review of Economic Studies

- #AlumniLive Seminar with Jaroslav Borovička on Inflation Expectations and Monetary Policy

- Jakub Kastl and Filip Matějka have published an article on personalized pricing and the value of time in Econometrica

- The Global and European Challenges for Security and Economic Policy Forum was opened by President Petr Pavel

- May (4)

- March (4)

- February (2)

- January (2)

- December (9)

- 2024 (59)

- December (8)

- Apply for Master's and PhD Programs at CERGE-EI!

- Introducing CERGE-EI's Job Market Candidates 2024/2025

- Yaroslav Korobka Received the 2024 Stapleton Scholars Award

- Talking Economics Emerging Scholars: Sinara Gharibyan

- The Price of War: Understanding Conflict Economics in a Volatile World

- Professor Gérard Roland Received Award for Long-Term Contribution to the Development of Czech Economic Learning

- Congratulations to Our Alumni Excellence Fellowship Recipient Jose Gomez Castro

- The Czech Economic Society awarded the Young Economist of the Year 2024 Awards

- November (2)

- October (7)

- The Week of the Czech Academy of Sciences at CERGE-EI

- Professor Jan Švejnar Was Awarded a State Decoration for His Work

- IMF Regional Outlook for Europe: A Recovery Short of Europe's Full Potential

- CERGE-EI Alumni Spotlight: New Roles at Harvard, IMF, and More

- Acemoglu, Johnson and Robinson Win 2024 Nobel Economics Prize

- Julie Chytilová Received the 2024 Czech Science Foundation President’s Award

- Meet Our Alumni: Ekaterina Travova

- September (5)

- Jakub Steiner Elected a Member of the Learned Society of the Czech Republic

- Prague Conference on Real-Time Data Analysis, Methods and Applications

- Talking Economics Emerging Scholars: Daniil Kashkarov

- The Economics Institute Supports the Candidacy of Jiří Plešek for the Position of President of the CAS

- Christian Ochsner awarded the Jan Švejnar and Katherine Terrell Teaching Prize at CERGE-EI for 2023/2024

- August (5)

- July (1)

- June (9)

- New Academic Placements for CERGE-EI PhD Candidates

- Meet Our Alumni: Tamta Sopromadze

- Second-Year Research Fellowships Recipients Announced for 2024

- Congratulations to Michal Bauer on Being Named Professor at Charles University!

- Two CERGE-EI alumni among the most influential women in the Czech Republic

- #AlumniLive Seminar: Banking Beyond Borders: Insights into Emerging Markets

- Additional Application Round Open

- Graduation Ceremony 2024

- High Energy Prices and High Levels of Regulation Threaten European Growth

- May (5)

- Talking Economics: Behind Bars and Beyond - Insights into Criminal Behavior and the Czech Justice System

- Roundtable Debate on the Current Challenges for Czech Economic Policy

- Meet Our Alumni: Daniel Husek

- The Czech Academy of Sciences Awards Two CERGE-EI Scientists with the Title "Doctor of Science"

- Heterogeneous Agents in Macroeconomic Models

- April (5)

- March (4)

- February (4)

- January (4)

- December (8)

- 2023 (71)

- December (7)

- Admissions to PhD program open

- CERGE-EI News at the Turn of the Year 2023

- Sympathy and Support

- Nastiness in Groups

- The Czech Economic Society awarded the Young Economist of the Year 2023 Awards

- Filip Matějka Receives the Prize of the Berlin-Brandenburg Academy of Sciences

- Jan Zápal and Jan Švejnar become committee members of European Economic Association

- November (5)

- October (1)

- September (5)

- August (2)

- July (6)

- June (8)

- Filip Matějka Named Charles University Professor

- Webinar for Applicants: Academics & Admissions

- People of CERGE-EI: Meet Our Alumni

- New Academic Job Placements for CERGE-EI PhD Candidates

- Insights from #AlumniLive Seminar with Juraj Valachy

- Webinar for Applicants

- WEast conference 2023

- What happened in May at CERGE-EI

- May (6)

- April (2)

- March (10)

- Liyou Borga: Investing in Mental Health Will Pay Off Very Well

- Academics from CERGE-EI received the Bedřich Hrozný Prize

- People of CERGE-EI: Meet Our Faculty

- Rational Inattention: A Review

- Greetings from PRINCETON

- Ante Šterc Took Third Place in CSE's Young Economist of the Year Award

- February 2023 at CERGE-EI

- Open Day 2023 - recording

- People of CERGE-EI: Meet Our Faculty

- People of CERGE-EI: Meet Our Faculty

- February (9)

- Štěpán Jurajda: Social Isolation is Costly

- Policy Brief by Jan Švejnar

- Ukrainian solidarity or a lingering fear of the unknown?

- People of CERGE-EI: Meet Our Faculty

- People of CERGE-EI: Meet Our Alumni

- January 2023 at CERGE-EI - we started a new year

- Open Classes

- Jan Hanousek Jr. - Young Economist of the Year

- (Virtual) Open Day 2023

- January (10)

- Sebastian Ottinger: Just a Few People Can Make a Difference

- People of CERGE-EI: Meet Our Researchers

- People of CERGE-EI: Meet Our Alumni

- CERGE-EI in the Media in 2022 - How Did We Do?

- CERGE-EI Scientists' Top Journals Publications at the Start of 2023

- CERGE-EI Researchers Have Received GA CR Grants

- CERGE-EI Succeeded in the Awards of the Czech Economic Society

- People of CERGE-EI: Meet Our Faculty

- CERGE-EI News at the Turn of the Year 2022

- December at CERGE-EI

- December (7)

- 2022 (83)

- December (7)

- People of CERGE-EI: Meet Our Faculty

- Congratulations to Michal Kejak on Being Named Professor at Charles University!

- People of CERGE-EI: Meet Our Alumni

- People of CERGE-EI: Meet Our Faculty

- Michal Bauer Receives Education Ministry Award for Outstanding Scientists

- Congratulations to Our Alumni Excellence Fellowship Recipient

- November at CERGE-EI

- November (8)

- People of CERGE-EI: Meet Our Alumni

- Azizbek Tokhirov Becomes First Recipient of Newly Established Stapleton Scholars Award

- Gérard Roland: Empires, Nation States, and Democracies: Perspectives on the War in Ukraine

- Human: Solving the Global Workforce Crisis in Healthcare

- Jan Švejnar - "Where We Are and Where We Are Heading"

- Top CERGE-EI economists in the Media

- October 2022 at CERGE-EI

- Second-Year Research Fellowships Recipients Announced for 2022

- October (11)

- The Price of War Symposium

- The Week of the Czech Academy of Sciences - Daniel Münich

- The Week of the Czech Academy of Sciences - Filip Pertold

- SYRI National Institute seeks concrete recommendations for crises

- People of CERGE-EI: Meet Our Alumni

- Monetary Policy since the 1970s: There and Back Again

- Nobel Prize in Economics recognizes research on banks and crises

- CERGE-EI is a Czech Treasure

- Nobel Prize in Economics 2022

- September 2022 at CERGE-EI

- Summer 2022 at CERGE-EI

- September (5)

- Labor Economics: Yesterday, Today, and Tomorrow

- Klára Kalíšková: There Are Big Reserves in Increasing Labor Force

- CERGE-EI to participate in the EXCELES program supported by the National Recovery Plan

- Newly established Stapleton Scholars Award to support mobility of excellent CERGE-EI students

- Alumni Picnic Prague

- August (3)

- July (2)

- June (8)

- Silvester van Koten: We Need to Address the Shortage of Oil and Gas

- People of CERGE-EI: Meet Our Alumni

- IDEA Talks: Štěpán Jurajda on the legacy of the liberation of the Sudetenland

- Two CERGE-EI alumni among the most influential women in the Czech Republic

- IDEA Talks: Michal Bauer talks about new study published in Nature

- Conference on education impacts of the Covid-19 School Closures

- Daniel Münich: It’s not about establishing Ukrainian classes and Ukrainian schools

- Doctors can help build trust in COVID-19 vaccines

- May (4)

- April (7)

- People of CERGE-EI: Meet Our Alumni

- CERGE-EI Celebrates Its 30th Anniversary in NYC

- VoxEU.org: "The price of war: Macroeconomic effects of 2022 sanctions on Russia"

- QS World University Rankings by Subject Confirm Economics and Econometrics at Charles University in the Top 150

- CERGE-EI Media Highlights for March

- The Oil and Gas Embargos Would Cut the Russian Export Revenue by Only One Quarter

- Two CERGE-EI’s Researchers Join the Minister of Labor and Social Affairs’ Advisory Team

- March (13)

- Think-Tank IDEA: Teacher Turnover in Europe

- People of CERGE-EI: Meet Our Alumni

- Master’s in Economics Research as Preparation for a PhD Career

- Admissions Deadline is Approaching. Get in Touch if Interested!

- Jared Laxton: "Not Everybody Is Able to Make Decisions under Uncertainty."

- Stalin and the Origins of Mistrust

- Fulbright Distinguished Scholar in Economics at CERGE-EI

- CERGE-EI Media Highlights for February

- Ph.D. Candidates Successfully Finishing Their Studies

- Ole Jann Joins the Advisory Team of Czech Deputy Prime Minister

- Ukraine Emergency Relief Fund

- Virtual Open Day Accessible for Watching on YouTube

- Štěpán Jurajda Appointed to Serve as Vice-Chairman of the R&D&I Council

- February (6)

- CERGE-EI Fully Supports Charles University's Position on the Situation in Ukraine

- IDEA Talks: State Employees and Civil Servants. Where Do They Work and How Much Are They Paid?

- CERGE-EI Media Highlights for January

- Jan Švejnar: "Being Average Is Not Enough."

- IDEA Talks: Abolition of Super-Gross Wages, Reductions in Social Security Contributions, and the Introduction of Tax Holidays

- The Cost of Unrest: Ukrainian Economy and Society in a Time of Crisis

- January (9)

- People of CERGE-EI: Meet Our Alumni

- What Will the Abolition of Super-Gross Wages, Reductions in Social Security Contributions, and the Introduction of Tax Holidays Mean?

- Think-Tank IDEA: "Sick Pay: What Impact Did the Introduction of a Waiting Period Have?"

- President Appoints Milena Králíčková First-Ever Female Rector of Charles University

- CERGE-EI Experts Will Help Define Public Policy

- Think-Tank IDEA: Where the First Draft Expenditure in the State Budget for 2022 Was Headed

- CERGE-EI Media Highlights for December

- Think-Tank IDEA: State Employees and Civil Servants. Where They Work and How Much They Are Paid

- Nikolas Mittag: The Pandemic has Brought on Questions for Designing Government Programs

- December (7)

- 2021 (100)

- December (11)

- PF 2022

- Anniversary Wishes: Štěpán Jurajda, Filip Matějka, Jakub Steiner

- The Average Czech Household Payment for Energy Will Increase by 940kc/Month

- People of CERGE-EI

- Anniversary Wishes: Byeongju Jeong and Alena Bičáková

- Marek Kapička Receives the Czech Science Foundation Grant

- Anniversary Wishes: Gérard Roland and Orley Ashenfelter

- IDEA Talks: Family Policy in the Czech Republic

- CERGE-EI Media Highlights for November

- Richard Podpiera: COVID Was Not a Walk in the Park

- Anniversary Wishes: Angus Deaton and Paul Milgrom

- November (16)

- The Great Success of CERGE-EI’s Ph.D. Students

- Congratulations to our Alumni Excellence Fellowship Recipient

- Ph.D. Candidates Defending their Dissertations

- Anniversary Wishes: Tomáš Zima

- People of CERGE-EI: Meet Our Alumni

- Congratulations to MAER Graduates

- Think-Tank IDEA Launches Idea Talks

- Anniversary Wishes: Eva Zažímalová

- The Socioeconomic Gradient in Child Health and Noncognitive Skills

- Anniversary Wishes: Josef Zieleniec

- Daniel Münich: Increased Inequality Access to Good Education due to Covid

- Media Highlights for October

- Jan Švejnar: The Sky Is the Limit

- Ole Jann Receives Junior Star Grant

- Open Week: Master’s in Applied Economics

- A Medal of Merit, First Grade for Michal Mejstřík

- October (7)

- Silvester van Koten: Gas and Electricity Prices Should Go Down Around March 2022

- CERGE-EI Alumni among Winners of Climathon 2021

- People of CERGE-EI: Meet Our Alumni

- Benefits of Starting College in Bad Economic Times

- Media Highlights for September

- Nobel Prize in Economics: David Card, Joshua Angrist, and Guido Imbens Share the 2021 Award

- Standing up to Retraction of Inconvenient Research

- September (11)

- People of CERGE-EI: Meet Our Alumni

- Postdoctoral Placement at Paris School of Economics for Branka Matyska

- PhD and MAER Orientation Week

- Švejnar-Terrell Teaching Prize for 2020/2021 Goes to Ctirad Slavík and Paolo Zacchia

- Filip Pertold: Data Was the Key Over the Past Year

- Financial Support for Students in Higher Education in the Czech Republic: a System Overhaul Is Required

- New MA in Applied Economics Cohort Starts their Studies

- CERGE-EI Media Highlights for August

- Ph.D. Candidates Successfully Finishing Their Studies

- Uzbekistan Successes

- Teachers' Salaries in 2020 and Beyond: Will the Czech Republic Rest on Its Laurels?

- August (4)

- July (7)

- People of CERGE-EI: Meet Our Alumni

- Second-Year RSJ Research Fellowships Recipients Announced for 2021

- Experientia Foundation Visits CERGE-EI

- Congratulations to Our New MAE Graduates!

- Eva Hromádková: May We All Live Again in the Boring Times

- Bibliometrics Underpins Charles University Research (Behind the Scenes with Daniel Münich)

- CERGE-EI Media Highlights for June

- June (9)

- People of CERGE-EI: Meet Our Alumni

- Jan Švejnar: The Challenges Are Enormous (Talking Economics Podcast)

- Last Call for Applications: MA in Applied Economics

- IDEA Study: Intervention Is Needed

- We Are Deeply Saddened by the Death of Professor J. Peter Neary

- VoxEU.org: “Crime and Punishment”: How Russian banks anticipated and dealt with global financial sanctions

- CERGE-EI Media Highlights for May

- Poverty and People's Economic Behaviour

- Dissertation Workshop presentations started

- May (3)

- April (7)

- IDEA Study: Social Status in Apprenticeships in the Czech Republic

- IDEA Webinar: How Influential Are Scientific Publications Across European Countries and Disciplines?

- Calling for Help. Who Needs It the Most? Štěpán Jurajda in the Show The Questions of Václav Moravec

- People of CERGE-EI: Meet Our Alumni

- New IDEA study: The gap in in-person teaching caused by the pandemic will cost the Czech economy staggering sums of money in the future

- CERGE-EI Media Highlights for March

- Happy Czech Day of Education!

- March (8)

- People of CERGE-EI: Meet Our Alumni

- The CERGE-EI Second-Year RSJ Research Fellowship 2021 call for applications is now open!

- Watch the Conference "The Future of Education in the Czech Republic" with Jan Švejnar

- Daniel Münich and Jan Švejnar: Keynote Guests of the "Investment and Investment Finance in the Czech Republic" Webinar

- Learn About Studying Applied Economics at CERGE-EI

- CERGE-EI Media Highlights for February

- Jakub Steiner Will Join a Panel Discussion at [PANDEMIC] Open Data Expo

- Watch our "Webinar II: Student Life at CERGE-EI" on YouTube

- February (11)

- Economist Prof. Jaromír Vepřek Passed Away

- A New Library Drop Box at the Jan Kmenta Library Entrance

- A Study on Sibling Spillovers on College and Major Choice Published in QJE

- People of CERGE-EI: Meet Our Alumni

- This Year's Virtual Open Day Accessible for Watching on YouTube

- Former MAE Student Listed in Forbes 30 under 30 List for 2021

- We Are Deeply Saddened by the Death of Professor Jan Sokol

- Analysis on Predatory Journals Was Published in Scientometrics

- CERGE-EI Media Highlights for January

- Štěpán Jurajda Appointed to Serve as Chairman of the Commission for Evaluation of Research Organizations and Programs

- Filip Matějka is Part of a New Expert Group for ERC Grants

- January (6)

- December (11)

- 2020 (71)

- December (8)

- CERGE-EI News at the Turn of the Year 2020

- Jakub Steiner's Paper to be Published in Econometrica

- People of CERGE-EI: Meet Our Alumni

- Two Grants From GACR For CERGE-EI Researchers

- CERGE-EI Media Highlights for November

- Filip Matějka Has Received the Consolidator Grant from the European Research Council

- CERGE-EI Students Among the Awarded at The Young Economist of the Year Competition

- The Spirit of Giving Back at CERGE-EI

- November (10)

- CERGE-EI Represented at Conferences on Education, Industry 4.0 and COVID-19

- Time to Apply for the MA or PhD Program

- Congratulations to the First-Ever Alumni Fellowship Recipients

- People of CERGE-EI: Meet Our Alumni

- Learn About Studying Applied Economics at CERGE-EI

- We Are Deeply Saddened by the Death of Our Student

- CERGE-EI Media Highlights for October

- People of CERGE-EI: Meet Our Alumni

- Prof. Rudolf Zahradník, Initiator of the Economics Institute, Passed Away

- 'Economic Decathlon' Part of the Program of The Week of Science Festival

- October (11)

- Prof. Dr. Zdeněk Pertold passed away

- Charles University Holds Its Position in the Best Global Universities Ranking

- CERGE-EI Researchers Succeded In TA ČR Grant Competition

- Early Bird Applications for the MA in Applied Economics

- Jan Zápal Received the Lumina Quaeruntur Fellowship From the Czech Academy of Sciences

- Jan Švejnar in Discussion With Jeffrey Sachs at Forum 2000

- Nobel Prize in Economics For CERGE-EI ESC Member Paul Milgrom

- Top Economic Scholars to Present at CERGE-EI

- Economics Discovery Hub Opens Its Fifth Season

- People of CERGE-EI: Meet Our Alumni

- CERGE-EI Media Highlights for September

- September (5)

- August (3)

- July (6)

- Students From 17 Countries Taking Part in the Online "Prep"

- Congratulations to Our New MAE Graduates!

- People of CERGE-EI: Meet Our Alumni

- Paolo Zachia's Research Project Recommended for Primus Grant by Charles University

- Students of Applied Economics Showcased Results of Project Seminar

- The Gold Medal of Charles University Awarded to Štěpán Jurajda

- June (6)

- CERGE-EI Commemorated the Victims of The Communist Regime

- Štěpán Jurajda to Share His Thoughts on the "Post-COVID Economy" in an Online Discussion

- Second-Year Research Fellowships Recipients Announced

- Georgiana Puscas is the New Economic Talent 2020

- IDEA anti COVID-19 recommends investments in tracing and testing capacity

- New Economic Talent 2020 Finalists Announced

- April (7)

- Postdoctoral Placement at Bocconi for Vladimír Novák

- CERGE-EI Researchers Working on the Model antiCOVID-19

- Few Days Left to Complete Applications for MA or PhD Studies

- Economics Discovery Hub Continues Online

- CERGE-EI Experts Involved in the National Economic Council of the Government

- Representatives of CERGE-EI are Members of the Coronavirus Crisis Response Economic Team

- Experientia Foundation Financially Supports the ‘IDEA anti Covid-19’ Project

- March (8)

- CERGE-EI Researchers Influencing the Debate on the COVID-19 Response

- Application Deadline Prolonged for All Study Programs and NET

- Our Researchers and Students Are Taking Part in the "IDEA ANTI COVID-19" Project

- Marek Kapička: Interest Rate Cuts Will Not Help, Targeted Fiscal Aid to Affected Sectors Would Be Better

- Admissions Deadline is Approaching. Get in Touch if Interested!

- The Public Lecture by Oliver Hart Is Rescheduled

- Rescheduled: Leading Expert on Auction Design Prof. Klemperer to Present at CERGE-EI

- Rescheduled: Fair Taxation in a Mobile World as the Topic of the 2020 EEAG Report

- February (3)

- January (4)

- December (8)

- 2019 (43)

- December (5)

- November (4)

- October (5)

- September (5)

- August (2)

- July (4)

- June (4)

- May (3)

- April (2)

- March (3)

- February (5)

- January (1)

- 2018 (40)

- December (4)

- November (1)

- October (5)

- September (5)

- August (3)

- July (4)

- June (3)

- May (1)

- April (5)

- March (4)

- February (3)

- January (2)

- 2017 (32)

- December (4)

- November (3)

- October (2)

- September (6)

- The New Academic Year Begins

- The 2017/18 MAE Program Opened with an Applied Human-Centered Design Project

- Martina Lubyová Becomes the Education Minister of the Slovak Republic

- Doc. Milan Horniaček - Obituary

- CERGE-EI Researchers Win the 2017 Exeter Prize

- Švejnar-Terrell Teaching Prize 2017 Awarded to Daniel Münich

- August (1)

- July (4)

- May (5)

- April (2)

- March (3)

- February (2)

- 2016 (38)

- December (3)

- November (4)

- Czech Economic Society Awards Go to Four CERGE-EI Community Members

- Results of the New Economic Talent 2016 Student Competition: Congratulations to the Winners!

- CERGE-EI Launched its Economics Discovery Hub to Give University Students Access to First Class Educational Activities for Free

- CERGE-EI Alumna becomes an Executive Director at the International Monetary Fund (IMF)

- October (2)

- September (2)

- August (4)

- July (3)

- June (3)

- May (4)

- April (7)

- MA in Applied Economics Placements and Prospects

- 25th Anniversary Gala

- Recent Job Placements of CERGE-EI PhD Candidates 2016

- CERGE-EI Undergraduate Program Named the World´s Second Best

- CERGE-EI Hires Five New Faculty Members

- PhD in Economics Application Deadline: 30 April, 2016

- Life After New Economic Talent: Interview with Salim Turdaliev

- March (2)

- February (1)

- January (3)

- 2015 (44)

- December (2)

- November (5)

- CERGE-EI Students Dominate Young Economist of the Year Competition

- Conference "Labor Economics and Its Public Policy Impact on Economic Growth" - Summary

- MA in Applied Economics Students Won BCG Strategy Cup 2015!

- PhD Program Open Days at CERGE-EI, 25 and 26 November, 2015

- CERGE-EI condemns the atrocious terrorist attack in Paris

- October (7)

- Week of Science and Technology 2015

- CERGE-EI opens Applied Economics Discovery Hub

- Filip Matějka Wins Prestigious ERC Grant

- Sveriges Riksbank Prize in Economic Sciences Awarded to Angus Deaton

- Students and Faculty Members Race for a Good Cause

- Award for Best Student Paper Goes to CERGE-EI Researcher

- Corporate Finance at the Applied Economics Discovery Hub – Big Picture, Applied and Fun!

- September (6)

- Jan Švejnar and Katherine Terrell Teaching Prize 2015

- Rector Emeritus of Charles University Radim Palouš Passed Away

- CERGE-EI Holds Teaching Fellows Program Training Course

- What Role for Economic Literacy in Democratic Reform? CERGE-EI Foundation Joins Forum 2000 Annual Conference on Democracy and Education

- American Statistical Association Publishes Research by Nikolas Mittag

- 15th Global Development Network Regional Research Workshop at CERGE-EI

- August (1)

- July (3)

- June (5)

- May (1)

- April (3)

- March (4)

- February (5)

- Jakub Matějů wins the very first Alumni Award for the Best CERGE-EI Student Paper

- Alumni Award for the Best CERGE-EI Student Paper Now Open for Submissions

- A Recipe for Inspiration

- Quality of CERGE-EI Research Recognized in the 2014 Global Go To Think Tank Index!

- Open Day at CERGE-EI, 6 March, 2015 from 13:00

- January (2)

- 2014 (43)

- December (5)

- November (1)

- October (5)

- CERGE-EI Teaching Fellows Have Positive Impact at 55 Universities in the Region

- Jean Tirole Wins Nobel Prize for Economics

- CERGE-EI Participates in the Week of Science and Technology

- Levent Çelik Awarded the Jan Švejnar and Katherine Terrell Teaching Prize

- CERGE-EI Staff Receive ‘Institutional Cooperation’ Norway Grants

- September (3)

- August (4)

- July (2)

- June (6)

- May (7)

- April (2)

- March (3)

- February (1)

- January (4)

- 2013 (12)

- December (3)

- November (1)

- October (2)

- September (3)

- May (1)

- March (2)

- 2012 (17)

- December (3)

- November (1)

- October (1)

- September (2)

- August (1)

- June (1)

- May (3)

- April (2)

- February (1)

- January (2)

- 2011 (20)

- November (4)

- October (2)

- September (2)

- August (1)

- July (1)

- June (5)

- New Alumni Research Featured on VoxEU.org

- CERGE-EI Welcomes New Students to the Preparatory Semester

- Prague Economic Meeting at CERGE-EI with Lubos Pastor and Adam Szeidl

- Michal Bauer Awarded the Otto Wichterle Award 2011

- CERGE-EI Students' Contribution to the Report on Anti-Corruption Measures on June 9, 2011

- April (2)

- February (1)

- January (2)

- 2010 (5)

News

What Will the Abolition of Super-Gross Wages, Reductions in Social Security Contributions, and the Introduction of Tax Holidays Mean?

28 January, 2022

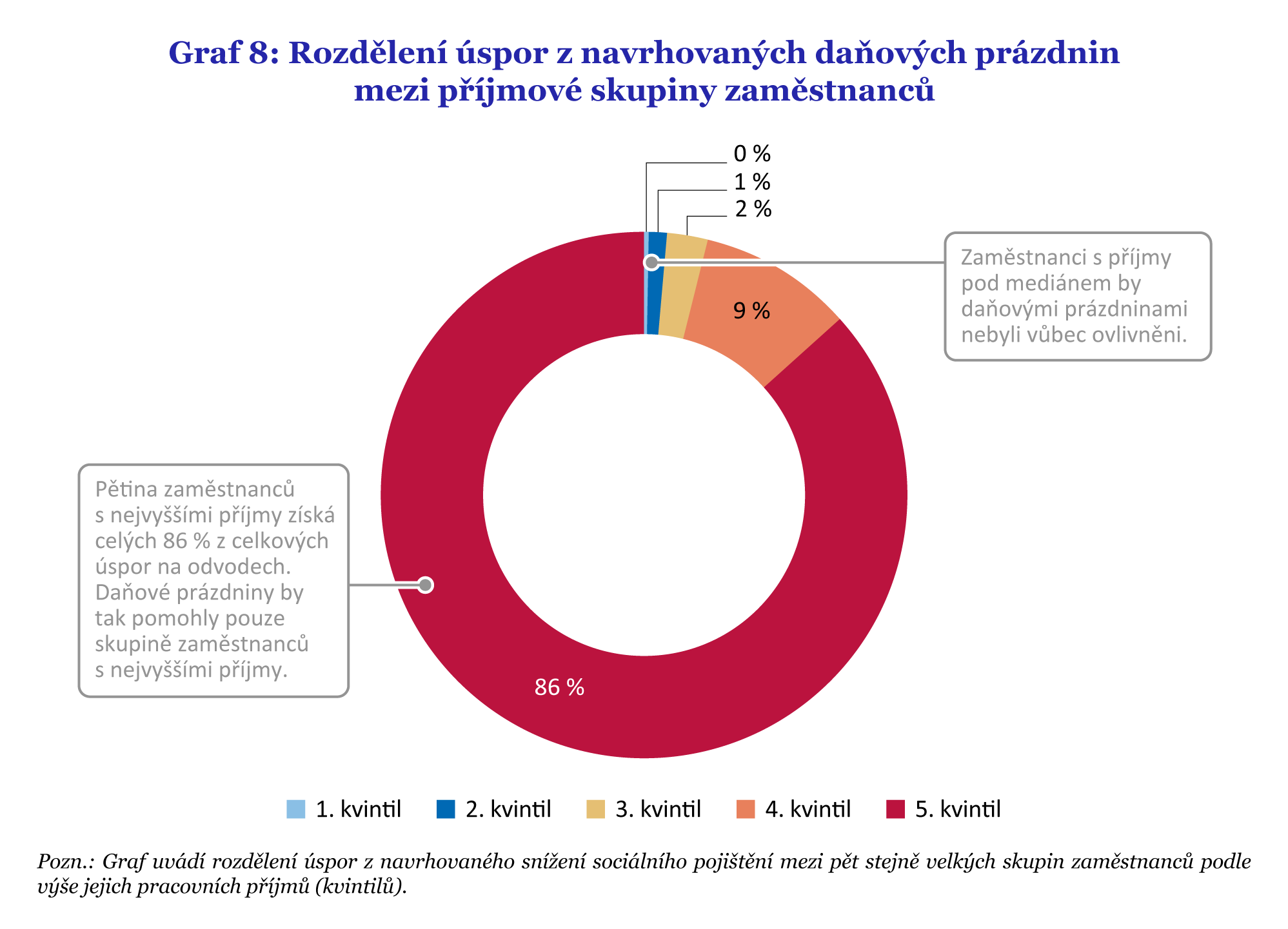

Tax holidays promised in the Czech government's program statement would have a negligible impact on all employees except the most profitable, a new study by Klára Kalíšková and Michal Šoltés from Think-Tank IDEA suggests.

The study analyzes the real impact of the proposed introduction of tax holidays as set out in the policy statement issued by the new Czech government led by Petr Fiala. It should apply to families who receive the parental allowance or have three or more children. The impact on those families would be extremely limited. Such tax holidays would benefit almost exclusively employees in the highest fifth by income.

Furthermore, suppose such tax holidays were limited to within a certain income bracket, as the policy statement implies. In that case, such a policy would likely have almost no effect.

The study also analyzes the effects of tax legislation's changes adopted in December 2020 and July 2021. It will reduce public revenues in 2022 by about 116 billion CZK (from 227 billion CZK to 111 billion CZK). In other words, in 2022, employees will pay less than half the income tax they would have paid without these tax changes. Workers in the lowest income quintile will save 500 CZK per month on average, whereas those in the highest income quintile will save an average of 4,000 CZK each month.

The Technology Agency of Czech and the Czech Academy of Sciences supported Think-Tank IDEA's production of "We've done the sums for you: Here's what the abolition of super-gross wages, reductions in social security contributions, and the introduction of tax holidays will really mean." The full study (in Czech) is available on Think-Tank IDEA's website.